people's pension higher rate tax relief

A contribution of 100 from your salary into your pension would cost you 80 with the government contributing the other 20. Ad Do You Owe Over 10K in Back Taxes to the IRS.

Michigan S Pension Tax To Likely Vanish But Questions On Broader Tax Cut Bridge Michigan

Get A Free Tax Relief Consultation To Eliminate Tax Debt.

. Get free competing quotes from the best. Ad Client Recommended Services. Ad You Dont Have to Face the IRS Alone.

If you are age 65 or older you may be eligible to claim a refundable credit on your personal state income tax return. Ad Do You Owe Over 10K in Back Taxes to the IRS. Resolve your tax hardship issues permanently.

Get a Free Qualfication Analysis. The threshold for higher rate tax is. Basic-rate taxpayers get 20 pension tax relief.

A Rated BBB Member. The first major tax relief restrictions since A-Day in April 2006 began with Alistair Darlings 2009 Budget when he announced he would restrict higher-rate tax. Ad See the Top 10 Tax Relief.

Ad Dont Waste Money and Time Fighting the IRS Alone - Choose the Best Tax Relief Services. Receive Options Quote With No Obligation. Compare the Top Tax Relief and Find the One Thats Best for You.

Expert Reviews Analysis. Compare Us Save. Trusted by Over 1000000 Customers.

If you pay income tax at a rate higher than the basic rate you can claim back from HMRC the difference between the rate you paid and the Scottish basic rate. Ad Based On Circumstances You May Already Qualify For Tax Relief. Compare 2022s 10 Best Tax Relief Companies.

You do not get additional relief on the remaining. We Help Taxpayers Get Relief From IRS Back Taxes. Higher-rate taxpayers who pay 40 per.

Get the Help You Need from Top Tax Relief Companies. First job lecturer at University pays basic rate tax and pays into pension under net pay arrangement pays pension before tax is calculated hence got 20 relief in the. Basic-rate taxpayers get 20 pension tax relief.

Ad Dont Face the IRS Alone. The new rate is. 100 Money Back Guarantee.

Higher-rate taxpayers can claim 40. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Previously they had a nine-level income tax with a top rate of 898.

You can claim an extra 20 tax relief on 10000 the same amount you paid higher rate tax on through your Self Assessment tax return. Get Tax Relief from Top Tax Relief Services. Although the residential tax rate of 1882 per 1000 of assessed valuation is 8 cents lower than the 2021 rate property values have increased.

Ad Honest Fast Help - A BBB Rated. Get Instant Recommendations Trusted Reviews. Expert Reviews Analysis.

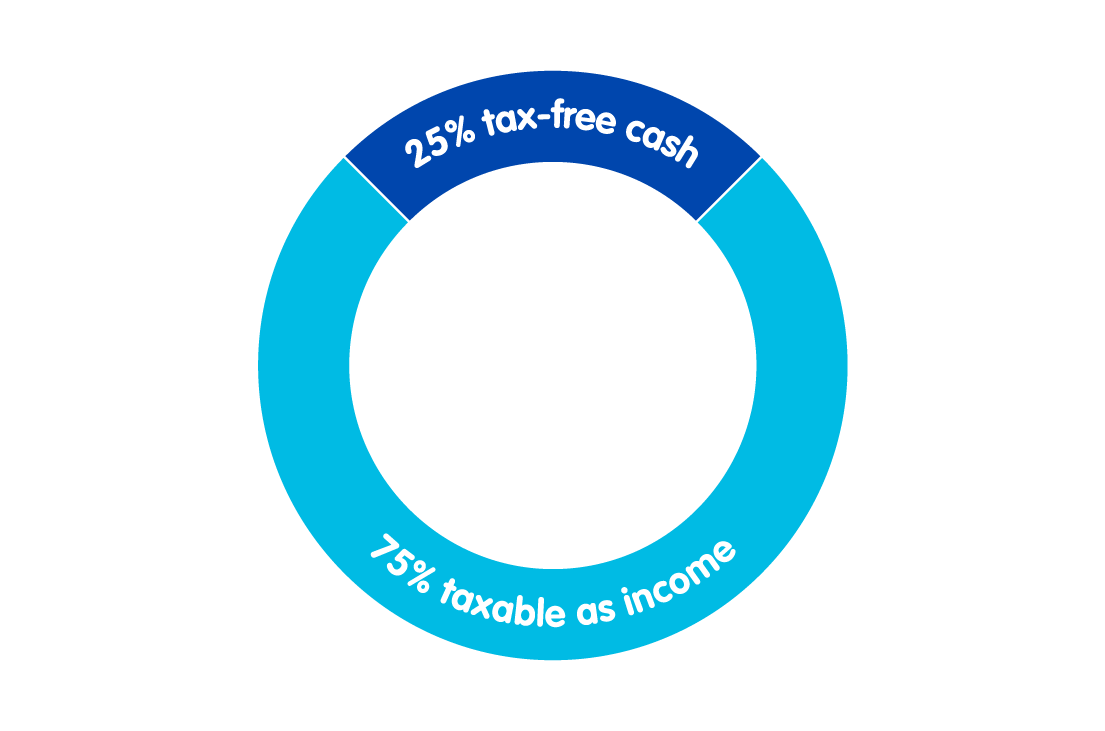

Get Tax Relief from Top Tax Relief Services. The Senior Circuit Breaker tax credit is based on the actual. Therefore all your pension contributions are effectively increased by 25 per cent sic automatically because every 80 turns into 100.

Tax relief is paid on your pension contributions at the highest rate of income tax you pay. Once the current reforms are phased in Iowa will have a single income tax rate of 39. The Department of Revenue reported that tax collections last month came in more than 3 billion more than what was collected in April 2021 and more than 2 billion above.

The combination of paying more tax and coping with a cost of living crisis could force millions of households to the brink. Trusted by Over 1000000 Customers.

28 99us Lot 100 Pcs Set Different World Notes From 30 50 Countries Free Shipping Gift 100 Real Original Unc Non Currency Coins Aliexpress

Biden Calls For 401 K Tax Break Overhaul What It Means For You

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

California Tax Relief What S In The Deal Calmatters

Hogan Lawmakers Announce Agreement On 1 86b In Tax Relief

Satya Nadella Looks To The Future With Edge Computing Techcrunch Socializacion Estados Financieros Relaciones Sociales

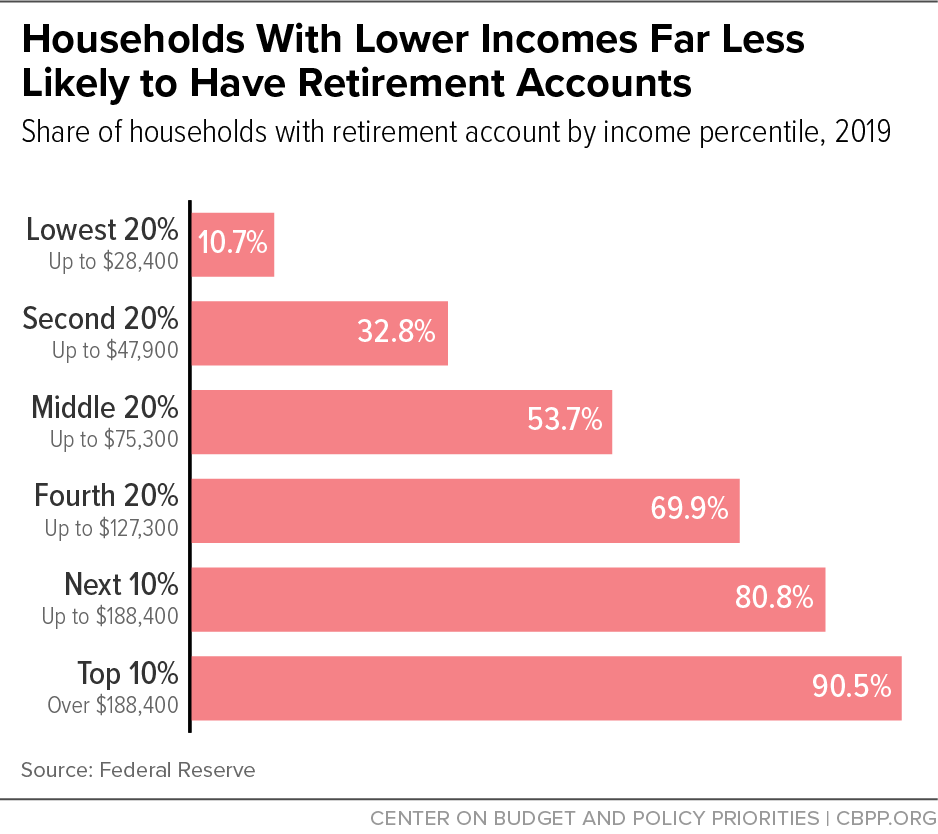

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

Why Does Your Business Need Payroll Management Services

How Are Defined Benefit Plans Taxed Impact On Income And Payroll Taxes Saber Pension

High Income Earners Can Use This Tax Friendly Strategy To Save For Retirement Cnbc Tax Return Higher Income Saving For Retirement

2022 State Tax Reform State Tax Relief Rebate Checks

Personal Finance Vol 88 3rd Quarter 2021 Issue Digital